Mergers and acquisitions are a challenging time for everyone. From the moment of the company announcement to the post-integration restructuring, employees are often left feeling adrift and frustrated, with more questions than answers. “Everything is kept very hush-hush, but employees know something’s going on — that can add a tremendous amount of distraction and fear for your team,” said Amy Spurling, founder and CEO of employee benefits platform, Compt.When employee performance is derailed, employees feel less engaged and committed to their organization. And because long-term business performance hinges on employee performance, organizations must prioritize employee motivation and morale at every stage of a merger to ensure long-term success.Ensuring that high performance lasts long after the deal is inked requires fostering trust, maintaining open communication, and creating structured processes that yields stability.

Before M&As: Drill Down into People Data

In the very first stages of an acquisition process, people data will be your baseline. HR data won’t just give you a snapshot of your workforce right now — it’ll tell you what to watch later on, and how the process is impacting your performance, organizational culture, and employee experience.

1. Calculate HR metrics to establish a baseline for change.

Nathan Deily, CPO at venture capital and private equity firm nth Venture said data collection is crucial during the pre- and post-transaction stages of a merger, because it helps you get ahead of team dysfunction. “Identify where the talent is in the organization, particularly on the specific teams where change is heaviest,” Deily said. “And make sure decisions are made based on that data to support the strategic intent.”Human resources teams can track a variety of metrics to help make those data-driven decisions:

- Turnover: Knowing your average turnover will give you a barometer for your current culture and help identify teams with retention issues that are worth digging into before bringing the other organization into the fold.

- Engagement: M&As can dent employee morale, having a negative impact on performance. Identifying engagement hotspots will help you track how these evolve, and enable you support with short-term interventions. Remember: dwindling survey participation can also be a sign that engagement is taking a hit.

- PTO utilization: A 2022 literature review found that when engagement is low, absenteeism is likely to spike, negatively affecting performance. Analyzing how and and when employees use leave can provide an early warning for disengagement, as well as highlight any emerging stressors.

- Career progression: Growth is a critical driver of employee engagement and performance. Understanding who’s progressing — and who isn’t — can highlight which employees are already a flight risk due to lack of opportunities.

2. Identify each team’s top performers.

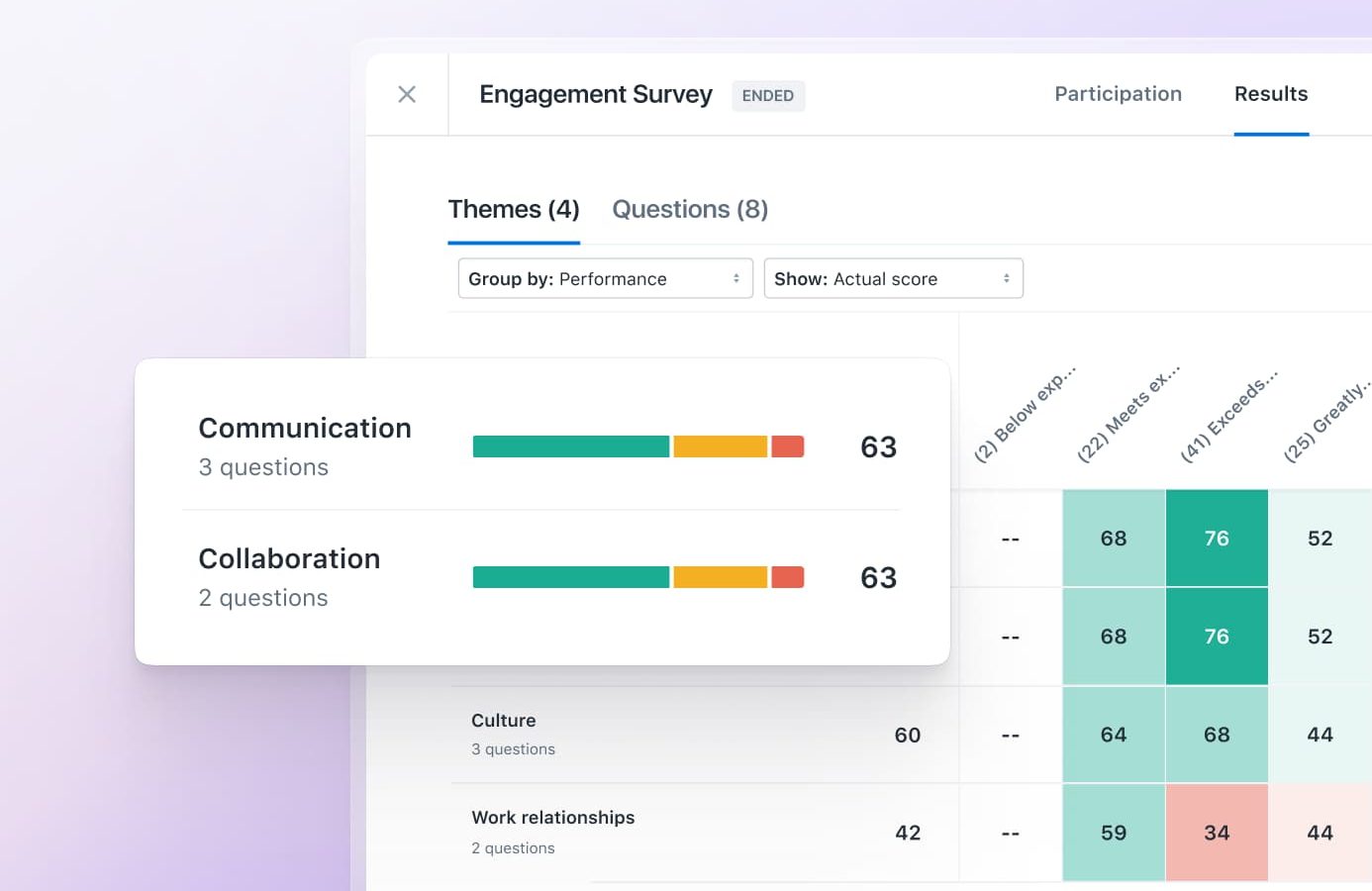

Layoffs and restructuring are common during M&As, so identifying your top performers is critical to providing your employees with the environment they need to do their best.Connecting performance management with employee engagement will give you further insight, providing quantitative and qualitative data on where and why performance challenges are popping up. For example, employees on one team rate their work-life balance more negatively than other teams, meaning their current goals may exceed capacity. Knowing what’s creating roadblocks for top performers means you can take action to maintain momentum and prevent regrettable turnover.[caption id="" align="aligncenter" width="634"]

An HR manager reviews the results of a recent engagement survey in Lattice, grouped by employee performance. From here, she can also filter the results fields by department or manager.[/caption]

3. Run stay interviews to discover more nuance.

M&As are a time of anxiety and change — some employees may already be planning their exit when the news breaks. At this stage, stay interviews help to assess future talent needs and take proactive measures to keep your top performers from becoming flight risks.Stay interviews are one-on-one interviews conducted by a manager or HR to evaluate employees’ day-to-day experience at your organization. While the goal is typically to assess each employee’s motivations, challenges, and ideas for workplace improvement, you can use these to identify the most pivotal aspects of the company, team, and role to preserve them during and after the merger. These interviews should be focused on the employee experience, and prompt reflection on growth paths, team structure, and company culture. For more guidance on leading stay interviews, download our Stay Interview Template.

During M&As: Maintain Trust with Regular Communication

“Employee performance issues during M&As tend to be based on fear and anxiety derived from the merger itself,” Deily said. “This is why clear and transparent communication on a regular basis is very important.” Top-down communication must be a core part of your integration plan — but it’s just as important to listen actively to employee needs and offer multiple ways for employees to make their thoughts heard.

1. Prioritize transparency to maintain trust.

While you might not always be able to share progress on the acquisition process, not saying anything at all can leave room for panic and fear. “Rumors start when you’re not communicating what’s going on,” said Spurling, who has led teams through five M&As. “Be as transparent as possible, but also let people know what will not be transparent. This gives your employees more understanding of what’s going on.“But trust has to be there before you even start,” she added. “That way, your employees know you have their best interests at heart, and understand your decision making processes.”A communication plan is an essential part of the change management process. Leaders must communicate across multiple platforms and formats, and involve multiple stakeholders to garner trust. Managers can help the information flow to their teams, while HR teams must be equipped to offer answers on core employee concerns.

2. Leverage surveys to identify functional needs.

During times of organizational change, employees may be feeling a wide range of emotions, which can make it harder to be candid when asking difficult questions or stating needs.The key to supporting employee performance is assessing and addressing those hidden needs, which Deily recommended uncovering through pulse surveys.“Employees will often feel more comfortable talking about what ‘everyone’ said rather than going out on a limb to voice their own opinion — they’re already potentially anxious,” he said.He recommended HR leaders and managers look for early warning signs of stress and strain across the company, especially from employees who are most affected by the merger process — but these signs will only be evident if you already have a baseline from prior survey results.“These surveys don’t give you the answer, but are often a clue as to how to ask the right questions [in a supportive environment],” Deily added. “It’s just as important to really listen to the answers you are getting from employees.”

3. Empower leaders to engage with employee feedback.

To maintain trust, communication needs to be aligned at all levels of your company, but HR can’t be the only steward of the messaging. “Change is seldom the issue, but how folks feel about it, [and] reducing the uncertainty and modeling the right behaviors is key,” Deily said.Senior management can bridge communication gaps with all-company meetings and increased office hours to address individual concerns. Managers, on the other hand, can establish regular touchpoints for day-to-day support with team check-ins and one-on-one meetings.“Employees will often feel less anxious if they are getting straight talk from above, [the] behavior matches the talk, and someone is listening to and responding to their questions or concerns in an authentic way,” Deily added.

After M&As: Create Stability and Alignment

Mergers can cause dysfunctional ripples long after the deal has been made. During the post-merger integration period, leaders and managers must help blended teams navigate cultural changes, build relationships, and merge processes that enable all team members to perform at their best.

1. Use foundational performance management to keep teams aligned.

Bringing in a new organization with its own processes and norms is always going to be an adjustment period. Performance management systems can become a welcome anchor during this time. Spurling and Deily said a goal-oriented approach can give teams greater ownership and control.“You can’t completely remove the fear, but you can use your processes to pull people together, give them a sense of calm, and keep them focused so that work can continue,” said Spurling.“A lot of managerial success is about helping employees focus their time and energy,” Deily said. “Telling people how they can help, and what actions they can directly take to participate in a successful change process is a great way to counter feelings of anxiety and helplessness.”Research backs this up. A 2021 study found that psychological ownership, autonomy, and involvement during merger processes are critical to supporting employee retention — especially in the acquired company.Providing new managers with performance management tooling and training is essential to removing friction from this period as teams forge new processes. It will also create alignment across blended teams.

2. Rebuild trust with communication and visibility.

Trust is essential for ensuring employee engagement during a merger — particularly for the company being acquired. But a 2021 study found it’s also essential for supporting the knowledge-sharing behaviors between teams to drive high performance and future success.Spurling said this depends on continued visibility and communication from the top as processes and culture settle into new norms. “M&A processes often involve so many closed-door meetings, and to your employees, it can feel like company leaders have disappeared,” she said. “Senior leaders must be as visible as possible after the process, as much as during. They need to actively participate with team members, answer questions and communicate as much as possible.”As both organizations settle into new norms and processes, leaders on both sides are now responsible for modeling new behaviors, communicating updates, and sharing information that enables employees to do their best.

Driving Performance During Mergers Relies on Effective Leaders

M&As may often seem like they’re focused on financial gain. But their ultimate success isn’t really about the billion-dollar deal that makes the headlines — it’s in how each organization is able to lead its people through the change.Employee performance is business performance. During a time of instability, organizations must focus on proactively creating the support, communication, and human resources management processes that drive trust and high performance — long-term.Find out more about building a high-growth culture that fuels performance in our new ebook, Fueling High Performance with Employee Growth in Insurance Companies.